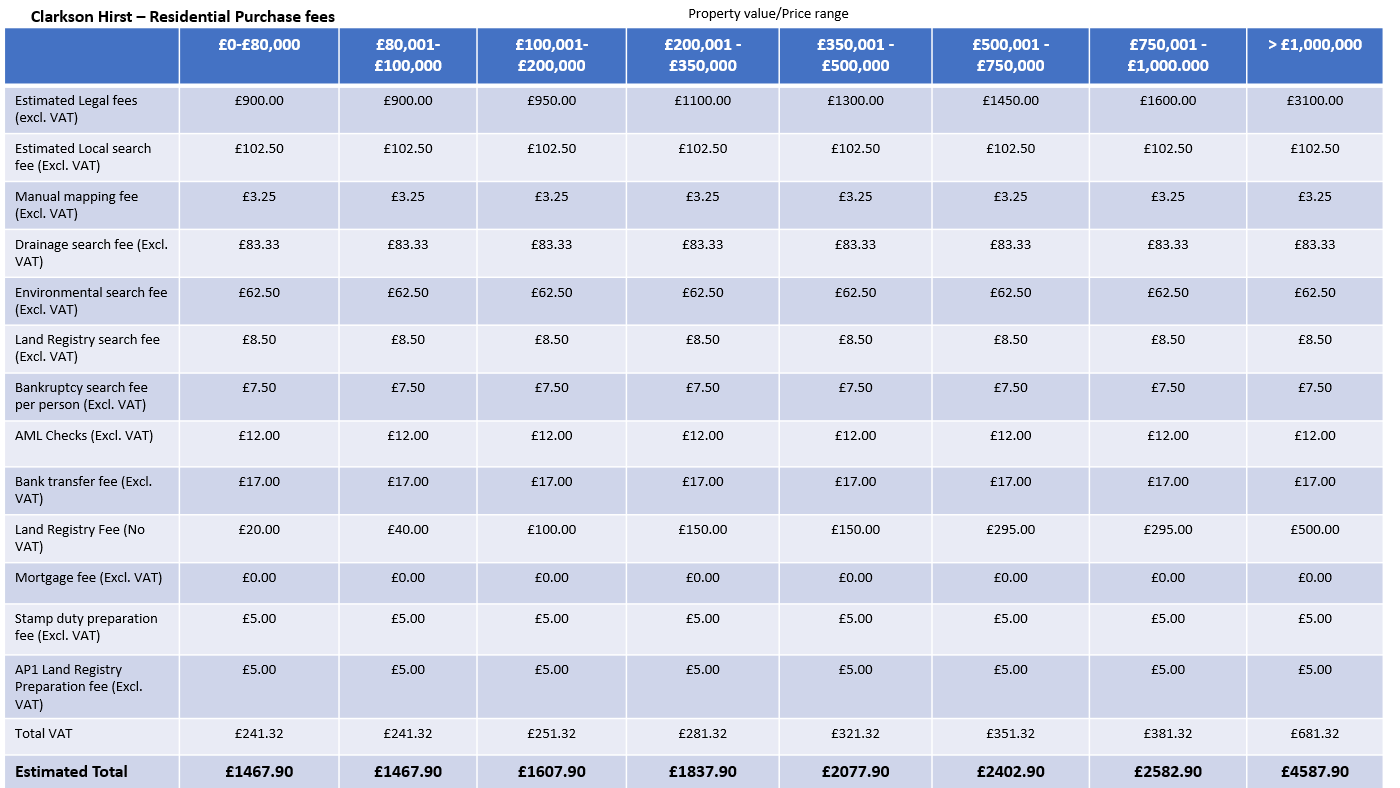

Residential Freehold Purchase

Our fees cover all of the work* required to complete the purchase of your new home, including dealing with registration at the Land Registry and dealing with the payment of Stamp Duty Land Tax (Stamp Duty) if the property is in England, or Land Transaction Tax (Land Tax) if the property you wish to buy is in Wales.

The experience of the solicitors and qualified staff dealing with your case.

Disbursements

Disbursements are costs related to your matter that are payable to third parties, such as Land Registry fees. We handle the payment of the disbursements on your behalf to ensure a smoother process.

Please note the land registration fee charged by the land registry will double where you purchase an unregistered or new build property.

Stamp Duty Land Tax (on Purchase)

This depends on the purchase price of your property. You can calculate the amount you will need to pay by using HMRC’s website or if the property is located in Wales by using the Welsh Revenue Authority’s website.

How long will my house purchase take?

How long it will take from your offer being accepted until you can move in to your

house will depend on a number of factors. The average process takes between 8-10 weeks.

It can be quicker or slower, depending on the parties in the chain. For example, if you are a first time buyer, purchasing a new build property with a mortgage in principle, it could take 12 weeks.

Stages of the process

The precise stages involved in the purchase of a residential property vary according to the circumstances. However, below are some key stages:

- Take your instructions and give you initial advice.

- Check finances are in place to fund purchase and contact lender’s solicitors if needed.

- Receive and advise on contract documents.

- Carry out searches

- Obtain further planning documentation if required.

- Make any necessary enquiries of seller’s solicitor.

- Give you advice on all documents and information received.

- Go through conditions of mortgage offer with you.

- Send final contract to you for signature.

- Agree completion date (date from which you own the property).

- Exchange contracts and notify you that this has happened.

- Arrange for all monies needed to be received from lender and you.

- Complete purchase.

- Deal with payment of Stamp Duty/Land Tax.

- Deal with application for registration at Land Registry.

If you are purchasing with the assistance of a Help to Buy mortgage or you are selling and redeeming a Help to Buy mortgage, we charge an additional sum of £300 plus VAT totalling £360 in respect of dealing with that transaction.

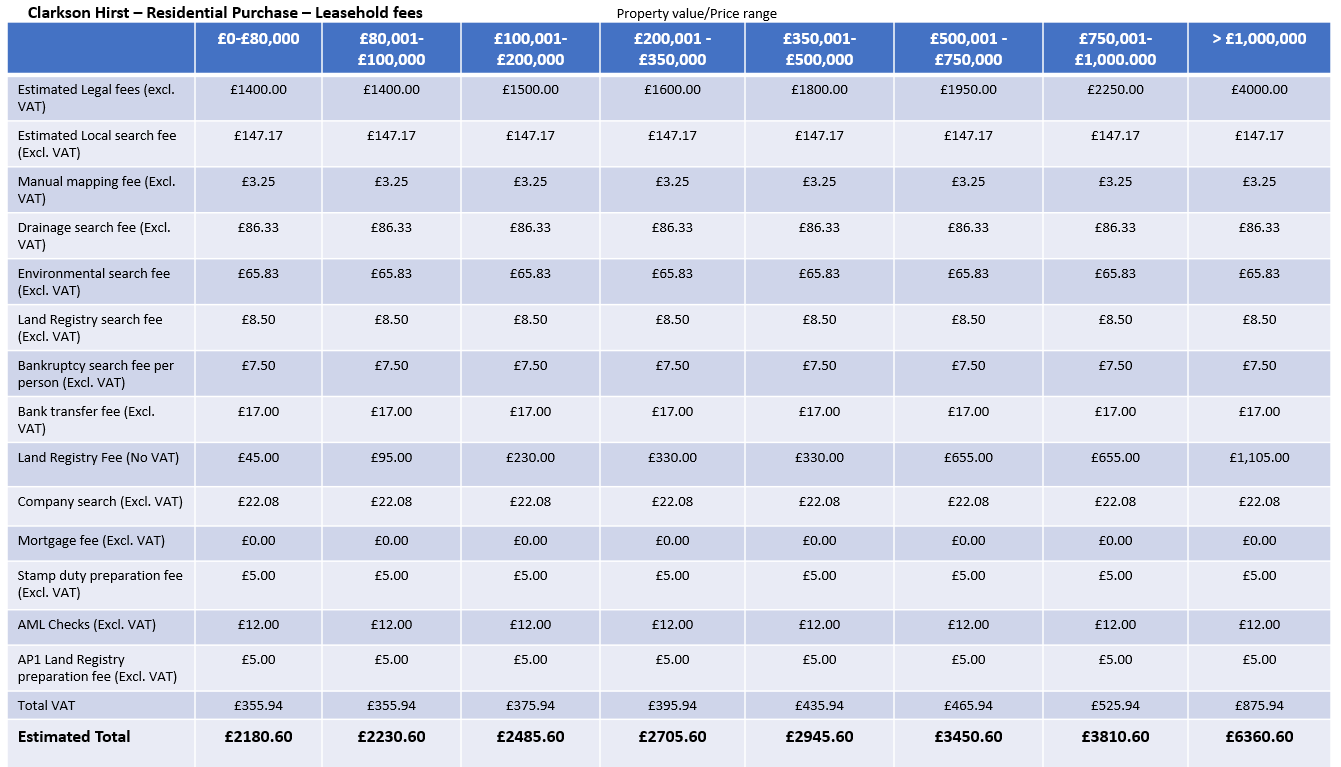

Residential Leasehold Purchase

Our fees cover all the work* required to complete the purchase of your new home, including dealing with registration at the Land Registry and dealing with the payment of Stamp Duty Land Tax (Stamp Duty) if the property is in England, or Land Transaction Tax (Land Tax) if the property is in Wales.

Please note that we do not act in cases where the Building Safety Act 2022 applies and we would advise you to seek advice from your surveyor as to whether the Act applies to the property you are purchasing. Generally, this would be a high rise flat or building with flats in it which is 11 metres high or over 5 storeys containing at least 2 flats. We do act in relation to shared ownership leases, but the price structure below does not apply to those properties and you should telephone our office for a tailored price.

The experience of the solicitors and qualified staff dealing with your case.

Disbursements

Disbursements are costs related to your matter that are payable to third parties, such as search fees. We handle the payment of the disbursements on your behalf to ensure a smoother process. There are certain disbursements which will be set out in the individual lease relating to the Property. The disbursements which we anticipate will apply are set out separately below. This list is not exhaustive and other disbursements may apply depending on the term of the lease. We will update you on the specific fees upon receipt and review of the lease from the seller’s solicitors.

Please note the land registration fee charged by the land registry will double where you purchase an unregistered or new build property.

Additional Fees

- Notice of Transfer fee – This fee if chargeable is set out in the lease. Often the fee is between £100 and £200.

- Notice of Charge fee (if the property is to be mortgaged) – This fee is set out in the lease. Often the fee is between £100 and £200.

- Deed of Covenant fee – This fee is provided by the management company for the property and can be difficult to estimate. Often it is between £100 and £200.

- Certificate of Compliance fee – To be confirmed upon receipt of the lease, as can range between £100 – £200.

*These fees vary from property to property and can on occasion be significantly more than the ranges given above. We can give you an accurate figure once we have sight of your specific documents.

You should also be aware that ground rent and service charge are likely to apply throughout your ownership of the property. We will confirm the ground rent and the anticipated service charge as soon as this we receive this information.

Stamp Duty Land Tax

This depends on the purchase price of your property. You can calculate the amount you will need to pay by using HMRC’s website or if the property is located in Wales by using the Welsh Revenue Authority’s website.

Stages of the process

The precise stages involved in the purchase of a residential property vary according to the circumstances. However, below are some key stages:

- Take your instructions and give you initial advice.

- Check finances are in place to fund purchase and contact lender’s solicitors if needed.

- Receive and advise on contract documents.

- Carry out searches

- Obtain further planning documentation if required.

- Make any necessary enquiries of seller’s solicitor.

- Give you advice on all documents and information received.

- Go through conditions of mortgage offer.

- Send final contract to you for signature.

- Draft Transfer.

- Advise you on joint ownership.

- Obtain pre-completion searches.

- Agree completion date (date from which you own the property).

- Exchange contracts and notify you that this has happened.

- Arrange for all monies needed to be received from lender and you.

- Complete purchase.

- Deal with payment of Stamp Duty/Land Tax.

- Deal with application for registration at Land Registry.

How long will my house purchase take?

How long it will take from your offer being accepted until you can move in to your house will depend on a number of factors. The average process takes between 8-10 weeks. It can be quicker or slower, depending on the parties in the chain. For example, if you are a first time buyer, purchasing a new build property with a mortgage in principle, it could take 12 weeks. However, if you are buying a leasehold property that requires an extension of the lease, this can take significantly longer, between 12 and 16 months. In such a situation, additional charges would apply.

* Our fee assumes that:

- this is a standard transaction and that no unforeseen matters arise including for example (but not limited to) a defect in title which requires remedying prior to completion or the preparation of additional documents ancillary to the main transaction.

- this is the assignment of an existing lease and is not the grant of a new lease.

- the transaction is concluded in a timely manner and no unforeseen complication arise.

- all parties to the transaction are co-operative and there is no unreasonable delay from third parties providing documentation.

- no indemnity policies are required. Additional disbursements may apply if indemnity policies are required.

If you are purchasing with the assistance of a Help to Buy mortgage or you are selling and redeeming a Help to Buy mortgage, we charge an additional sum of £300 plus VAT totalling £360 in respect of dealing with that transaction.

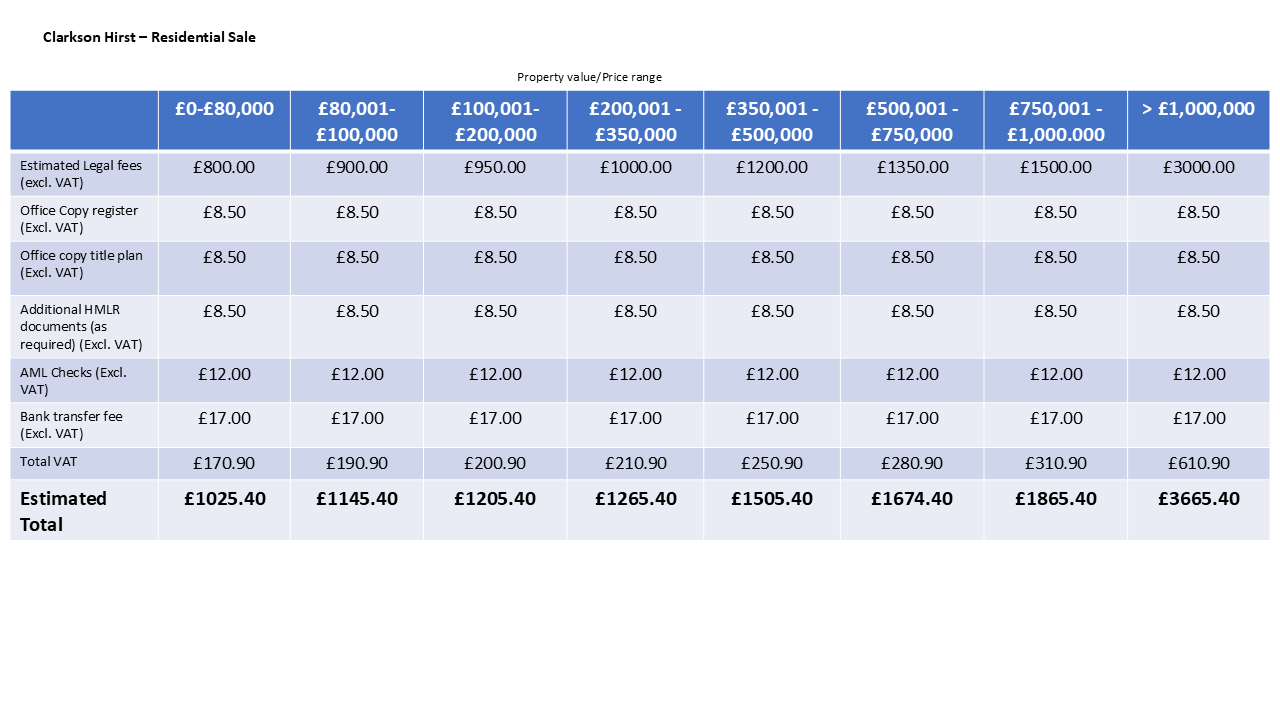

Residential Sale of a Freehold Property

Our fees cover all the work required to complete your sale. This includes preparing a contract, replying to questions about the property raised by the buyer’s solicitors, having you sign all the relevant documents to sell the property and then sell your property, pay off your mortgage and account to you for the sale proceeds. Our fees for this work are:

The experience of the solicitors and qualified staff dealing with your case.

Disbursements

Disbursements are costs related to your matter that are payable to third parties such as the cost of obtaining Land Registry records. We handle the payment of disbursements on your behalf to ensure a smoother process.

How long will your sale take?

This will depend upon the other parties in the chain. On average the process takes between 8-10 weeks. It can be quicker or slower depending upon how many parties are in the chain.

Stages of the process

The precise stages involved in the sale of a residential property vary according to the circumstances, however below we have included some key stages :-

- Take your instructions and give you initial advice

- Complete Property Information and Fixtures forms.

- Send the contract papers to the buyer’s solicitors.

- The buyer’s solicitors will approve the contract and raise any questions about the Property Information form and documents supplied.

- Answer the questions.

- Agree a completion date, which will be the date when you sell the property.

- Sign the documents to sell the property.

- Obtain the mortgage redemption statement if you have a mortgage so you know how much mortgage funds are to be repaid.

- Complete the sale, pay the mortgage fees, legal fees and estate agents’ fees and account to you for the balance or add the balance to any connected purchase.

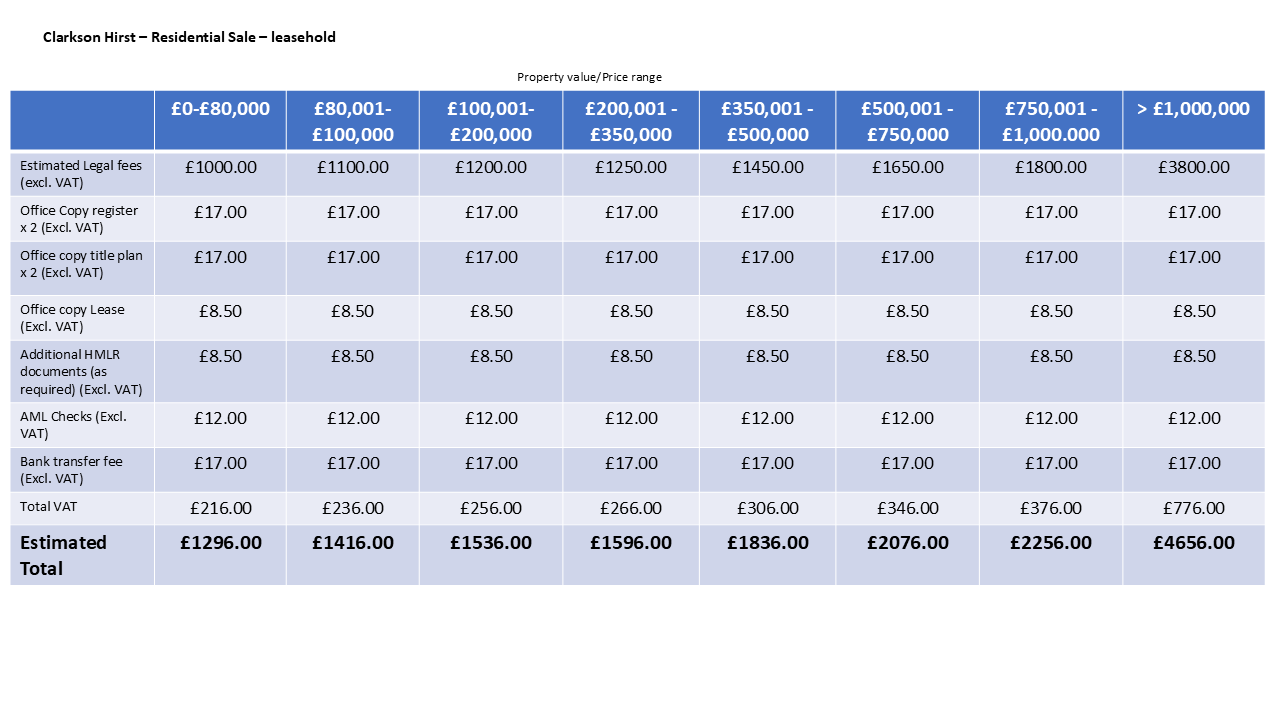

Residential Sale of a Leasehold Property

An estimate of our charges for dealing with this is as below :-

The experience of the solicitors and qualified staff dealing with your case.

Please note that we do not act in cases where the Building Safety Act 2022 applies and we would advise you to seek advice from your surveyor as to whether the Act applies to the property you are purchasing. Generally, this would be a high rise flat or building with flats in it which is 11 metres high or over 5 storeys containing at least 2 flats. We do act in relation to shared ownership leases, but the price structure below does not apply to those properties and you should telephone our office for a tailored price.

Disbursements

Disbursements are payments to third parties, and we will ensure these are paid on your behalf. You will in addition have to pay for a management pack if there is a management company that manages the development. The costs of management packs vary from provider to provider and generally will be in the region of £200 to £500. This is a fee payable to the management company and does not form part of the legal fees as such.

Steps we will take

A brief summary of the main steps taken are as follows :-

- Take your instructions and give you initial advice

- Complete the Property Information, Fixtures & Fittings forms and Leasehold Property Information form.

- Obtain the management pack from the Landlord/management company.

- Issue the contract to the buyer’s solicitors.

- The buyer’s solicitors will approve the contract and raise any questions.

- Answer the questions and agree a completion date.

- Obtain the mortgage redemption statement and advise you of the amount required to redeem your mortgage, if you have one.

- Complete the sale and account to you for the sale proceeds.

- We will pay off your mortgage, pay the estate agents.

- We will account to you for the balance of the sale proceeds or add them to the balance required to purchase the property if you have a linked purchase.

For our Conveyancing Terms and Conditions, please click here.